Louis Vincent Gave: ¿Y ahora qué?

A continuación os adjuntamos la newsletter que ha enviado esta semana Louis V. Gavel, del prestigioso equipo de research de Gavekal, en la que habla del efecto de los ETFs y la traslación del centro del mundo desde los países tradicionalmente desarrollados hacia los emergentes. Para muestra un botón traducido:

.

«Otro claro síntoma de que el entorno del mundo de la inversión ha cambiado es que los resultados inferiores de los mercados emergentes, que prevalecieron entre 2011 y 2016 (cuando cayó el petróleo, el USD subió y los yields se mantuvieron bajos), hoy claramente ya son historia. Estamos viviendo ahora en un mundo donde el rendimiento de los bonos tenderá a subir, el USD tenderá a bajar, y los precios del petróleo podrían mostrar presiones alcistas. En un mundo así, la exposición a los mercados emergentes una vez más resulta una recompensa. De hecho, un rasgo interesante de las recientes caídas es ver cómo la volatilidad de los mercados de renta variable norteamericano ha sido realmente mucho mayor que la de la mayoría de mercados emergentes. Incluso después de la caída de esta semana, los mercados asiáticos están significativamente mejorando los rendimientos de la renta variable global.»

.

Resulta curioso ver como poco a poco el centro del planeta inversor se desplaza desde los EE.UU. y Europa hacia Asia, y con ello, la volatilidad emprende el camino contrario. O sea que mientras el desarrollo llega a los emergentes, la volatilidad viaja hacia los países donde el desarrollo está lastrado por el sobreendeudamiento. Y lo lamentable es que para la mayoría de asesores y gestores de banca privada, las propuestas de inversión hacia países donde hay crecimiento económico y demográfico con una volatilidad en descenso (países emergentes), son de mayor «riesgo» que los tradicionales fondos europeos y americanos, donde la anemia y la volatilidad se apoderan de sus crecimientos. Seguramente la dificultad de encontrar buenos fondos emergentes comercializables en España sin disponer de un vehículo de inversión adecuado (donde quepa cualquier fondo, hedge fund o private equity del mundo mundial difiriendo su tributación como si se tratase de cualquier fondo que te vende el banco de la esquina) ayuda a que se sigan rellenando las carteras con los fondos de siempre. Pero la realidad es tozuda y el centro del mundo se desplaza inexorablemente hacia Asia, donde hay gestores impresionantes que consiguen alphas espectaculares.

.

A continuación la newsletter de Louis-Vincent Gave completa, que prácticamente no tiene desperdicio:

In Agatha Christie’s Murder on the Orient Express, the victim is stabbed by twelve different individuals.

The same is often true of bull markets; when they die, one finds many a finger-print on the murder weapon.

With that in mind, one could pin the death of the bond bull market on accelerating inflation, or on the globally synchronized global growth surge, or on the lack of investments in new capacity over the past decade (see A Brave New New World, attached), or even on the demographic shift unfolding in the Western World (see The Savings Glut’s Long Life and Slow Death), or simply on the realization that fiscal policies all around the world are bound to stay inordinately loose for far too long (see US Budget Deficits, attached)… But whichever reason one wants to hang one’s hat on, the bond bear market is likely here to stay. After all, if bonds can’t even rally by a few basis points as equity markets meltdown, then we must have a structural bond bear market on our hands.

And at the risk of stating the obvious, this structural bond bear market is now clearly a headwind for equities.

It also marks a profound shift in the investment environment.

In a piece written close to the market top (see A Once in a Generation Shift – attached), we highlighted that OECD bonds had been the perfect counterweight to equity positions for decades. However, it wasn’t always so. In periods when inflation picks up, OECD bonds do not protect portfolios against downside risk. Instead, they add to the downside risk. We also showed that one way to know whether we were in an ‘inflationary’ environment or a ‘deflationary’ environment was to look at the relative performance of long dated US Treasuries to Gold as both had asset classes tend to ‘trend’ over long periods of time. And when the ratio ‘gold to bonds’ moves ABOVE its 4 year moving average, that is typically a confirmation that we are moving into an inflationary environment. As the chart below highlights, following this week’s rise in yields, such a move has now just occurred:

So if OECD bonds are no longer a sound hedge for equity risk, what is an investor looking to reduce the overall volatility of his portfolio, to do?

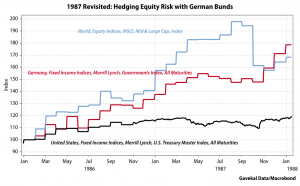

In the 1970s, and again in the 1987 crash, one of the best hedges (aside from gold), were German (and Swiss) bunds. Back then, the DM was slowly but surely establishing itself as Europe’s trading and reserve currency; a genuine alternative to a US$ weighed down by too many years of US ‘guns and butter’ policies. Take 1987 as an example: US interest rates rose until they broke the back of the (then) roaring equity bull market. But as equities cracked and the fed slashed rates, investors sought out the safe haven of the inflation-fighting Bundesbank. So much so that, by the end of 1987, for an investor looking back at January 1986, German bunds had actually outperformed not only US Treasuries (that wasn’t even close), but global equities as well:

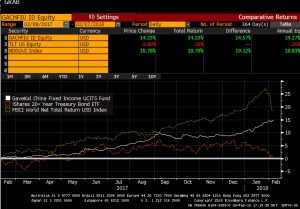

So, as Yogi Berra once said, is it ‘deja-vu all over again’? After all, in the US today, we not only have guns and butter; we should also soon have bridges, and tunnels, and hip replacements and student loan write-offs etc… (see The US Budget Deficits, attached). At the same time, we have China making a concerted push to turn the RMB into Asia’s DeutscheMark, a currency that will increasingly fund Asia’s trade and Asia’s capital spending. And sure enough, just as global equities (World MSCI in the chart below) and US Treasuries (TLT US in the chart below) have started to roll over, Chinese bonds (represented below by the Gavekal China Fixed Income UCITS fun) have held their own. In fact, like German bunds in the fall of 1987, the Gavekal China Fixed Income UCITS fund has returned over 14% in US$ terms which handily beats the flat return of long dated US Treasuries, and could approach the return of global equities should global equities repeat the past week in the near future!

Another clear sign that the investment environment has changed is that the underperformance of emerging markets, which prevailed between 2011 and 2016 (as oil fell, the US$ rose and bond yields stayed low) is now clearly over. We are now living in a world where bond yields will trend higher, the US$ is trending lower, and oil prices could show upside pressures. In such a world, exposure to emerging markets once again becomes rewarding. In fact, one of the interesting feature of the current pullback is how volatility on US equities has actually been much worse than that of most emerging markets. Even after this week’s pullback, Asian markets are significantly outperforming global equities. For example, our Asian Value UCITS fund (which focuses on developing Asia) is up +31.12% over the past 12 months, while our Asian Opportunities (which includes Japan, Australia and Asian bonds) is up +23.61% over the past 12 months. This compares favorably to the +19.4% gain in the World MSCI for the past year.

Still, the question at hand is whether we are now confronting a correction? The start of a crash? Or the unfolding of a genuine bear market?

- ARGUMENTS FOR A CORRECTION:

- We were due: record RSI indicators, record stretch without a 5% correction, first year without a down month etc…

- As mentioned above, the investment environment is changing. Deflation should no longer be a concern. Central banks will no longer be as supportive of asset prices. The US$ is done rising. Oil is done adding liquidity to the system. Interest rates are moving higher… Any one of these forces would be a lot for the market to digest. But all together, they may be like Diderot’s proverbial apricot, or Monty Python’s wafer-thin mint: a little too much to chew on.

- However, fundamentally, interest rates remain low, global growth is solid and so investors are likely to keep chasing returns?

“It’s not a crash, it’s a correction”

- ARGUMENTS FOR A CRASH

Old card-sharks will always say that “if you sit down at a poker table and after 30 minutes, you have not figured out who the fish is, then you are the fish”.

Of course, in recent years, there have been no fish. Everyone won as all asset prices rose: equities, bonds, corporate bonds, real estate… It was just a question of relative performance with equities doing best of all. Still, as the equity bull market matured, it also evolved. Widening its reach and grasping the savings of an ever wider percentage of the population. So much so that, to a large extent, the bull market of recent years could be described as the ETF bull market. Indeed, according to data from research firm ETFGI, the ETF industry’s assets under management (AUM) stood at $4.569 trillion in November 2017, compared to $3.396 trillion at the end of 2016. Assets under management of ETFs have grown by more than a trillion dollars in less than a year. Over 2016, in comparison, ETF assets grew by a relatively paltry $522 billion. Still, over the past two years, more than US$1.5 trillion of assets have flooded into ETFs. To put things in perspective, in 2017, the US mutual fund industry recorded a growth in assets of US$91bn. In short, last year, the growth of AUM in the ETF industry was basically ten times that of the mutual fund industry.

Now I manage money for a living. In fact, I took over the management of the Gavekal Global Equities Strategies almost exactly one year ago… and while the past three weeks have been tough (our overweight energy positioning did us no favors), we are still ahead of the World MSCI for the past 12 months (net of all fees):

The reason I highlight this is that I am sometimes called upon by our sales team to go pitch the fund. And invariably, a question that always comes up amongst smarter investors is “who are your other investors?”. And the reason smart potential investors ask this question is obvious enough: they don’t care much for owning a fund with ‘Nervous Nellie’ investors who will panic at the first sign of trouble, hereby forcing the management of the fund (i.e.: my team and I) into liquidating assets at the trough of a cycle, when we should instead be focusing on picking up bargains.

The premise behind the (often-asked) question is that owning assets with a bunch of ‘weak hands’ is not an attractive long-term proposition.

This obvious enough common-sense brings me back to the massive inflows into ETFs that we witnessed in the past two years. Are the ETF inflows “sticky money” that will stay invested through the market’s turmoils? Apparently, we witnessed US$30bn in ETF outflows last week (the first outflows in quite a while) and that was enough to create the dislocation we witnessed. What would happen to markets if those outflows reached 10% of the increase of the past two years, or US$150bn? What if the ETF outflows over the coming weeks reached 20%, or US$300bn? Who will take the other side of such large, incremental, marginal, trades?

To be clear: we have no way to know how sticky the ETF money will prove to be; if only because the inflows we have witnessed in the past two years are simply unprecedented. Meanwhile, the past few years have been so steady on financial markets that we have no real data to model how stable the ETF industry’s AUM could prove to be in periods of stress. The only thing we know for sure is that the ETF industry is today a much larger beast than it was in 2008. And it is by and large an untested, and unknowable beast. And then, we also know that:

- Historically, in periods of market stress, money tends to stay into mutual funds because mutual funds often charge upfront fees (the sunk cost fallacy), or because investors trust the managers they chose more than they trust themselves to navigate the market’s choppy waters (the expert fallacy), or because they have done a fair amount of due diligence and thus want to validate their hard work (the sunk cost fallacy, again…) etc… Meanwhile, the whole point of ETFs is that they cost next to nothing to trade, that they do not require large amounts of due diligence, nor a relationship with a manager, etc… Thus, if we assume that the reason some of the ETF investors like ETFs is that they are easy to get into, and just as importantly easy to get out of, then should we not worry that some of the investors who chose ETF for the ‘easy liquidity’ will likely wish to exercise that very ‘easy liquidity’ now that the markets have started to head south?

- Aside from higher liquidity, the other main reason investors like ETFs is the (perceived) low fees. And this is where the potential for disappointment could set in because of the difference in how ETFs and mutual funds trade. Let me use my own fund as an example. If tomorrow, an investor (Nellie Nervous), decides that she doesn’t like the look of markets and no longer wants exposure to a global equity strategy, Nellie puts in her redemption form (before the agreed cut-off time) for, let’s say, US$500k. I am then notified that by closing time tomorrow, US$500k will be leaving the fund. It is then up to me to decide whether I wish to reduce holdings across my 40 names proportionately, sell some of my exposure in US oil producers (in order to reduce the pain from my overweight energy stance), reduce some of my cash buffer etc… But whatever decision I have taken, by the next closing day, the money leaves the fund , Nellie Nervous receives her cash, which she can then deposit in short term UST, bitcoins, modern art, gold bars, etc…

Meanwhile, if Nellie owned US$500k of the QQQ (or SPX, or EWJ etc…), and decided to sell her ETF, what actually happens is that she places her sell-order with a broker, who (through the exchange) then turns to one of the “market-making” firms for that ETF. Assuming that, at this precise time, no-one is coming in to buy Nellie’s ETF (hereby allowing for the shares to simply move from one investor’s hands into another), then the market-maker (maybe Deutsche Bank, or Credit Suisse, or Morgan Stanley etc…) will give the exchange the price at which the market maker feels comfortable that it can unwind the position in the Nasdaq 100, or S&P 500, or MSCI Japan etc… And as we saw during the flash crash of May 2010, when markets unravel quickly, it can be hard for market-makers to keep up. At such times, the market-makers may well quote prices with greater and great discounts to NAV; which is how, back in May 2010, we saw a number of ETFs lose up to a third of their value, and sometimes more, while their underlying benchmarks were down just a few percent.

That was then. When the ETF market was much smaller, quainter, and less the plaything of the retail investment public than it is today. And so, with retail investors now in a full-on love affair with ETFs, let us imagine that, like a bad first husband coming out of prison, all of a sudden a liquidity squeeze like the 1987 crash or the 1998 LTCM meltdown re-appears. Not the start of a recession (a la 2001), nor a massive banking crisis (a la 2008), for neither looks likely today. But simply a good old fashioned liquidity squeeze, as investors realize that the investment portfolios they have constructed are now inadequate for the world in which we are moving (see A Once in a Generation Shift). With that, less us imagine US$150bn (or 10% of the past two year’s rise in AUM) of outflows from ETFs (To be clear: this is pure speculation, for who is to know what the retail investors will decide to do tomorrow? For all we know, he/she may decide that the recent 10% dip is a terrific buying opportunity and buy more ETFs!). If this were to occur, then the questions that will rapidly appear will be:

- Will the market-makers have the balance sheets to take on these transactions? If so, then

- Will the market-makers have the appetite to take on these transactions? And if so, then

- At what cost to the investment public, and profits to themselves (through higher spreads and discounts to NAVs) will the market markers decide to take on these transactions? If History is any indication, most likely a fairly large one. After all, what put the gold in “Goldman Sachs” and the more in “Morgan Stanley” has historically been the ability of investment banks to provide liquidity, at a high cost, to clients in the middle of a crisis. And if so, then

- Will the general investment public conclude that both the ‘liquidity’ and ‘low fees’ attributes of ETFs turned out to be “bull market mirages”? And if so then

- Will that realization encourage yet more ETF selling, bringing us back to square one, above? Wash, rinse, repeat…

In other words, was May 6th 2010 the dress-rehearsal for what could soon happen in the ETF world?

Back then, a number of investors found out the hard way that the ETF’s low fees hardly made up for the massive discounts to NAV that they suffered in the midst of a panic. With the experience of May 2010 in our rear-view mirror, and with a broader market sell-off now in the front and center of any investors’ concerns, will investors once again be forced to confront the question of what is the point of saving 0.2% per annum in management fees if, when one wishes to sell in a panic, one ends up selling one’s ETF at a 20% or more discount to NAV? Are ETF investors who think they can liquidate in a downturn going to have proven themselves to be “penny wise and pound foolish”? Will they be the fish to the card-shark investment banks?

- ARGUMENTS FOR SOMETHING WORSE?

In the Spring of 2008, the global economy was humming along. In fact, for those of us sitting in Asia, it was hard not to feel very enthusiastic about the future: the Asian Crisis was falling off of our ten year rear-view mirror, China was delivering the greatest rise in purchasing power, over the greatest number of people in one generation, ever recorded in the history of Mankind (that’s humankind for our Canadian friends). India looked set to join the global economy. Indonesia and Malaysia were developing fast, partly thanks to rising commodity prices, and partly thanks to attractive demographic profile. Even Brazil, of whom it was once said that “it is the next emerging market, and always will be’, was thriving.

Things were good. And then things turned bad very quickly.

Things were bad because the financial regulators, especially in the US but also to some extent in Europe, fell asleep on the job. They allowed banks to expand their leverage from the time-tested 10x, up to 40x and beyond. They rubber-stamped the creation of financial products that made little sense, (such as CDOs squared, PIK loans etc…) except that they allowed yield starved investors to gorge themselves – but without realizing the risks they were taking as they did.

Could History repeat itself?

Probably not, if only because banks are nowhere near as levered as they were in 2008.

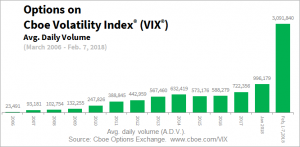

Still, one nagging concern is that, for the past five years, investors of all size and stripes (even small retail investors) came into the market day-in/day-out to sell volatility (daily volume on VIX options has risen from 23k in 2006 to 3m today!). This constant selling of volatility was just another way to ‘reach for yield’. And needless to say, the consequent downward pressure on volatility was very bullish for risk assets.

Projecting ourselves forward however, we can probably assume that the number of investors rushing to sell volatility forward will now be constrained to a smaller group of traders who actually understand what they are doing? Logically, this should mean that volatility should settle back closer to its long term mean of roughly 17%. If so, then that would mean that we would now confront an environment of higher interest rates and higher volatility… And if we have higher interest rates and higher volatility baked into the cake, doesn’t that almost guarantee lower PEs?

Following up on the above idea, we have seen in recent years, especially in the US, a rapid growth in quant funds, CTAs and risk parity strategies (witness the steady rise in SPX options trading). However, a number of these strategies were, in essence, levered longs on bonds and equities simultaneously, on the premise that bonds and equities are negatively correlated. However, as we surmised in our most recently Monthly, what happens if bonds and equities stop being negatively correlated? Well, obviously we now know the answer: the risk-parity, quants and algo traders have to start deleveraging their balance sheets aggressively in a market where the marginal buyer has, all of a sudden, disappeared. And the reason the marginal buyer has disappeared is that in recent years’ (as the picture below makes clear), the marginal buyer has started to look very different from the marginal buyer of past bull markets:

Which brings us back to the “yield-chasers” mentioned above. In my careers, every bear market has started with the ‘yield-chasing’ investors getting burnt. It is almost as if “the bear” enters a room and decides ‘First, I will eat the yield chasers. They are the easy preys. Then, if I am still hungry, I will eat the momentum guys. And if I am still hungry after that, I will have the value investors for desert’.

The fact that the yield chasers just got destroyed doesn’t mean that, de facto, the momentum and value guys are next. Maybe the bear has had its fill, and goes back to sleep (after all, it is hibernating season)? But still, when the yield chasers get eaten, we momentum and value guys have to realize that we are potentially next on the menu…

And all this brings me to perhaps the single most important reason to be cautious given recent developments: namely the fact that this is now the second crisis in a decade where US regulators have shown themselves to the world to be completely hapless.

After all, if the current sell-off really is the direct consequence in the implosion in the XIV.US, and other such products, then the first question we should ask ourselves is why these products even existed in the first place? I mean, what economic interest was served by allowing retail investors to pile their hard-earned cash into a product that, through its very conception, had an extremely high probability of being worth zero at least once, if not twice, a decade?

Are we back to where we were ten years ago, when all of a sudden, we all had to figure out what a CDO-squared was and how they could implode the global financial system?

It is it just that, this time around, it’s just a different bunch of letter but the core principle stays the same: let’s create products that allow the average punter to reach for extra yield, even at the cost of getting blown up once a decade! The ultimate “eat like a bird and sh.t like a cow” trade?

Honestly: why would US regulators even allow things like 3x levered Brazil ETFs, or worse yet, inverted VIX ETFs who, by design, are destined to go to zero in a time of market stress? What economic benefit is there to have such products offered to the general public? Or more appropriately, what point is there to have a financial regulator is the regulator allows for things like a reverse VIX ETF, or futures on Bitcoins?

Unfortunately however, if the past is any indication, regulators will respond to this latest market hic-cup by telling money managers how they can pay for research, or by clamping down further on offshore tax havens, or by dictating firm’s compensation policies… More regulations, of things that had nothing to do with the crisis in the first place! Thus, if the end result of all this is more lawsuits (one can bet one’s bottom dollar that a number of the investors wiped out in the Volageddon will not take their losses lying down), more regulations, higher interest rates and higher volatility… then it is hard to walk away from the past week with a strong “risk on” mentality?

Or at the very least, a strong “buy the dip” mentality. For there are still risks that offer attractive returns across a number of equity markets around the world. It may however, be very different markets, and different segments of the markets, from those who have done so well for investors over the past five years.

As always, please do not hesitate to reach out if you have any comments or questions.

Yours truly,

Louis-Vincent Gave

PS: PLEASE NOTE THAT THE ABOVE REPRESENTS MY PERSONAL VIEWS AND IS IN NO WAY AN OFFER TO BUY/SELL ANY SECURITIES.

Yo lo que no veo es el dólar bajo y el petróleo alto.

Partiendo de la base que no sabemos lo que puede pasar mañana, Asia y más concretamente China será el centro economico mundial, pero antes tienen que ganar en transparencia y neutralidad para atraer los grandes capitales. Eso de que el gobierno te «recomiende» comprar acciones no creo que le haga mucha gracia a los grandes Hedge Funds mundiales.

Los escenarios mundiales que se me ocurren para los próximos años serían:

1.-Seguir como hasta ahora, metiendo toda esa basura tóxica que hay debajo de la alfombra y a ver hasta cuanto se puede llenar.

2.- Que la alfombra ya esté llena y se tengan que corregir todos los desmanes habidos.

Sea cual sea el escenario, siempre acabaremos en el dos porque el que se volatice la basura no lo contemplo(¿Puede ser ese el error de mi forma de pensar?)

Para que pase el segundo escenario sería necesario que la deuda de los paises emergentes (y la de los no emergentes), colapsará y esa deuda está en USD; así que un USD bajo hace que no se dé el segundo escenario y beneficia muchísimo a los USA debilitando a China, por lo que ese relevo del que hablamos no se realizará .

En cuanto al petróleo, China no tiene suficientes reservas petroleras propias como para cubrirse y, además, el ciclo del petróleo como energía ya está en su fase de decaimiento como ya pasó con el carbón en su momento; lo afirmo porque cada vez hay más estudios buscando combustibles alternativos y es cuestión de tiempo que se encuentre una energía sustitutiva y volvemos al principio otra vez: China tiene que tener una independencia energética para ser el centro económico mundial.

Cierto que se puede decir que quedan muchos años para ello … pero con el nivel tecnológico que estamos alcanzando los plazos cada vez son más reducidos, basta con mirar lo que era el mundo hace 20 años y lo que es ahora.

Todo mi razonamiento lo baso en que es cierto que el centro económico mundial va a pivotar hacia Asia … pero se tienen que dar las condiciones para ello.

Un placer leeros y perdón por el tocho …

Franlodo 13/02/2018